By Alex Schwartz

New York City’s unprecedented and ongoing efforts in the realm of affordable housing show what cities can – and can’t – do strictly on their own to solve a deep and persistent affordability crisis.

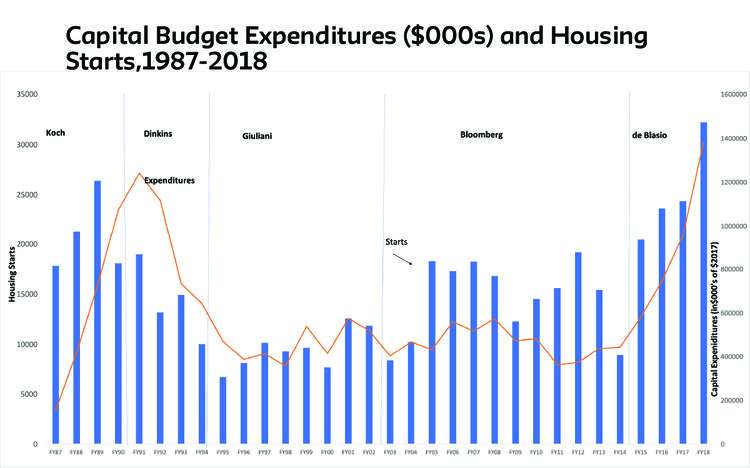

Since 1987, New York has invested more than $17.5 billion (adjusted for inflation) of its own capital resources on constructing and preserving more than 450,000 housing units. No other city has drawn on its own tax base to anywhere near this extent to help finance affordable housing, and no other city has sustained an analogous level of commitment for so many years under both Democrat and Republican mayoral administrations.

The administration of Mayor Bill de Blasio has sharply increased the scale of New York’s affordable housing investments. During his first term, annual City-supported housing starts for new construction and preservation averaged 25,000 units—far more than what previous mayors achieved. Compared with previous mayoral housing plans, de Blasio’s targets a larger share of its housing for extremely low-income households. In addition, his administration launched the nation’s first municipal initiative to provide free legal counsel to low-income renters at risk of eviction.

Source: Mayor’s Management Report and Comptroller’s Budget Report.

Nevertheless, New York’s affordable housing crisis remains as acute as ever. More than 29 percent of all renters spend at least one-half of their income on housing, including 78 percent of all extremely low-income (ELI) renters – those earning less than 30 percent of what’s called “area median income” (AMI) – currently about $96,000 a year for a three-person family. More than 60,000 people sleep in the city’s homeless shelters.

Despite the de Blasio’s administration’s efforts on behalf of extremely low-income renters, the tens of thousands of deeply affordable units produced so far pale by comparison with the overall need. In total, his plan aims to construct 12,600 units affordable to ELI and 17,400 units affordable to very low-income (VLI) households (with incomes between 30 and 50 percent of AMI) by 2028. This goal amounts to less than seven percent of all ELI and VLI renters who paid 50 percent or more of their income on housing in 2017, and that does not include the more than 63,000 people who were in the city’s homeless shelters.

For the City to primarily assist households with the lowest incomes, it would need to provide rent subsidies to cover the difference between what they can afford to pay and the total cost of operating the housing (insurance, utilities, upkeep, supplies, etc.) and also of covering the debt-service expenses connected to the housing’s acquisition and/or development or rehabilitation. As rental subsidies are expensive, the City would need to spend hundreds of millions or billions of dollars to support the same number of renters every year.

On average, depending on unit size and other factors, it costs between $500 and $700 every month to cover the basic operations of a housing unit eligible for City subsidy. It can cost several hundred dollars more to cover the expenses on the unit’s share of the building’s mortgage debt. For example, according to a 2018 study by the Furman Center for Real Estate and Urban Policy at New York University, the monthly costs of operating and paying the debt on a newly built efficiency apartment with shared bathroom and shared kitchen amounts to $840 a month, and that assumes that the development cost of the property did not include any expenses for land acquisition.

Even under this bare-bones scenario, the minimum monthly rent is only affordable to households earning at least $2,800 a month ($33,600 annually). All other households would require rent subsidies to afford this apartment. Excluding the portion of the rent that would cover debt service, even the unit’s basic operating costs of $332 per month would be unaffordable to households earning less than $13,267 a year, or 25 percent of all single-person households. The operating costs of a 400-square-foot studio apartment with private kitchen and bath amount to $418 per month, affordable only to people earning at least $16,700.

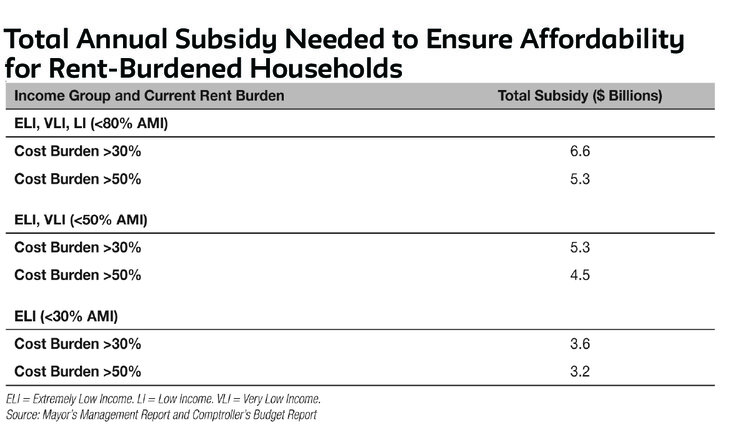

How much would it cost to provide rent subsidies so that all low-income New Yorkers do not confront housing cost burdens? In 2017, there were 286,000 unsubsidized ELI renters and 250,000 VLI renters. Of these renters, 87 percent spent more than 30 percent of their income on rent, and 62 percent spent more than 50 percent of their income on rent.

If New York were to subsidize all VLI households who are currently rent burdened so that they paid no more than 30 percent of their income on rent, it would cost $5.3 billion annually. The cost would rise to $6.6 billion if the subsidy applied to all households earning up to 80 percent of area median income that spend more than 30 percent of their income on rent. Conversely, if the subsidy were limited to ELI households spending 50 percent or more of their income on housing, the annual cost would be $3.2 billion.

To put these amounts in perspective, New York City spent $5.4 billion in Fiscal Year 2019 on police, $2.1 billion on fire protection, $1.7 billion on sanitation, and $461 million on parks. In other words, the costs of providing rental subsidies to eliminate housing cost burdens for most low-income renters would equal or exceed the annual budget for numerous City services.

It is, of course, a political decision whether to use City funds to subsidize rents. The $3-7 billion needed every year is probably politically if not fiscally prohibitive. In short, while New York City’s experience demonstrates that it is possible for cities to produce and preserve some housing that is affordable to the lowest-income residents, it also illuminates the limits of local initiative. The inescapable conclusion: Only the federal government commands the financial resources necessary to solve the affordable housing crisis, in New York City and in the rest of the nation.